Myth 12: The CNG strategy will hurt the poor the most

Has

anyone spared a thought for the many taxi and autorickshaw owners who

simply have no means either to buy a new vehicle or convert their existing

ones? Of course not (The Times of India, March 28, 2001).

Who considers the price paid and still to be paid by the office-goers,

workers, the auto drivers, the schoolchildren, the handicapped, and the

self-employed? (The Indian Express, May 3, 2001).

Fact

Financial

incentives are a must for the CNG strategy to work. The federal government

in the US provides 80 per cent of the cost of a basic transit bus and

90 per cent of the incremental cost of a bus running on alternative fuel.

The Society for Indian Automobile Manufacturers (SIAM) requested the Delhi

government for financial incentives for buses in September, 2000, but

no response has been received.

The state government can subsidise the capital cost of CNG-mode public

transport vehicles without incurring any charge on its existing budget.

Increasing

the price of diesel to that of Mumbai would have netted the government

over Rs. 450 crore in one year. A one-time increase of Rs. 7,500 in the

road tax for cars and Rs. 2,000 for two-wheelers will fetch the Delhi

government of Rs. 68 crore every year. In this way, private vehicle owners

can cross-subsidise the users of public transport who make a much better

use of road space.

As the key barrier to the CNG technology is its high capital cost, governments

across the world have provided fiscal incentives for the introduction

of natural gas vehicles recognising their environmental and public health

value. For instance, the federal government in the US provides 80 per

cent of the cost of a basic transit bus and 90 per cent of the incremental

cost of a bus running on alternative fuel. Thus, if a bus costs $35,000,

the local share is just about 10 per cent which can be amortised over

the life of a vehicle which is 12 years or 500,000 miles (805,000 kilometres).

In Italy, too, CNG/LPG vehicles get a subsidy. A major incentive for users

of CNG/LPG vehicles is that only they are allowed to ply on a bad pollution

day when there is a pollution emergency alert. In several countries this

is a tool used by governments to push vehicle owners to go in for CNG

vehicles. But a pollution emergency system does not exist in India.

While so much noise has been created over the high cost of CNG buses —

about Rs 16 lakh, all was quiet when Delhi government rolled out specially

designed air conditioned urban buses in June this year costing a staggering

Rs 54 lakh. It defies reason why focus is shifting to get even more expensive

buses when Delhi is still struggling to get comparatively cheaper CNG

buses.

Subsidies given by Delhi government to autos and taxis

Following the Supreme Court order of July 28, 1998, the Delhi government

offered certain forms of financial assistance to auto and taxi owners

to switch over to CNG (Cabinet Decision No. 503 dated 11.4.00). Both were

given a complete sales tax exemption. In addition, autos were given a

six per cent subsidy on interest on loans from the Delhi Finance Corporation

(DFC) and taxis a four per cent subsidy on interest on loans. But according

to the Delhi Auto Sangh, no new notification has been issued after March

31, 2001. The Society for Indian Automobile Manufacturers (SIAM) requested

the Delhi government for financial incentives for buses in September,

2000 but no response has been received.

According to Ganesh Budhhiraja, President of Delhi Auto Sangh, an auto

drivers union in the capital, because there is no incentive scheme available

for autos from the government, as new notification for financial incentives

and subsidies has not been issued after March 31, 2001 several auto owners

are taking advantage of a scheme of replacement offered by Bajaj Auto

Ltd to replace old petrol autos. While a CNG auto costs Rs. 1,43,000 on

road, an auto owner who turns in the old auto just has to pay Rs. 89,000.85

Possible

sources of revenue for providing subsidies

The

state government can subsidise the capital cost of CNG-mode public transport

vehicles without incurring any charge on its existing budget.

According to the National Capital Region Planning Board (NCRPB), a key

reason for the rapid growth of Delhi is the fact that even though it has

the highest per capita income in the country, it has an extremely low

tax regime and thus offers high job opportunities. As a NCRPB document

puts it, “The phenomenal physical and economic growth of Delhi and

the underdevelopment of the area outside Delhi, or, to be more specific,

outside the Delhi Metropolitan area, is primarily a problem of relationship

rather than a problem of scarcity. To give an example, the total journey

time from Delhi to the farthest towns in the region is so short that no

big centre of transportation and trading activities have developed in

the outer ring of NCR. The entire region outside the Delhi Metropolitan

Area is thus registering a relatively slow growth rate leading to a lop-sided

development of the region characterised by the ‘Metropolis-Satellite’

syndrome, where part of the economic surplus of the periphery is extracted

by the core and whatever development takes place in the periphery, mostly

reflects the expanding needs of the core. Under this phenomenon, the region

rather than adding or accelerating, went on supporting the growth and

prosperity of Delhi whereby setting an uneven system tied up in a chain

of ‘Centre-Periphery’ relationship. This relationship, helped

to raise the income levels in Delhi. Delhi with per capita income of Rs.

19,779 at current prices (1995-96), as compared to all India per capita

income of Rs 9,321, has the distinction of having highest per capita income

in the country. Thus, ample job opportunities couples with higher wages

and earnings provide enough opportunities for the people to migrate and

settle in Delhi.”86

“It has been strongly argued at various forums that whereas there

is a reasonable amount of uniformity in tax and tariff rates among the

neighbouring States, the effective rates of tax and tariff are substantially

lower in Delhi. These differentials in tax rates with added advantage

of better social and physical infrastructure in Delhi have greatly influenced

in past the decision making regarding location of industry and trade.

The articles where the margin of profit is low and transportation costs

are not so high, such variations result in attracting buyers from far-off

places,” points out the report.87

Diesel

prices

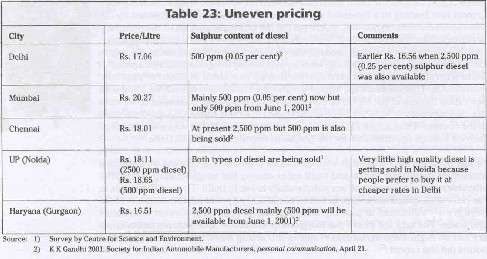

The low rate of taxation in Delhi is also reflected in the transport sector.

It has a diesel price not only lower than other metros but also lower

than neighbouring Uttar Pradesh which is much poorer and has lower quality

diesel to sell (see table 23: Uneven pricing).

Road taxes

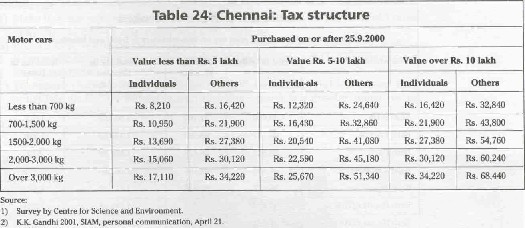

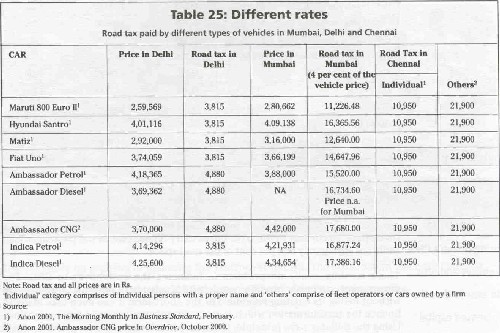

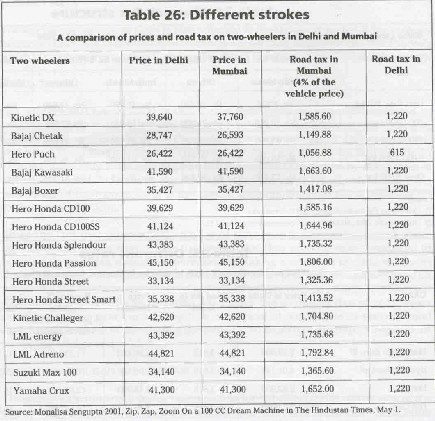

Not only are fuel prices lower in Delhi, even road taxes are very low

compared to other metros even though Delhi has more vehicles than Mumbai,

Chennai and Kolkata combined (see table 24: Chennai: Tax structure, table

25: Different strokes, and table 26: Different strokes). The road tax

for cars owned by individuals in Chennai is not only twice that of Delhi

but the tax for cars owned by companies is further increased. In Mumbai,

the road tax is not the same for all vehicles but is a percentage of their

price. Even in the case of scooters, the road tax is relatively on the

lower side in Delhi.

Given the fact that these private modes of transport occupy a disproportionate

amount of space compared to the passenger-trips they provide when compared

to buses, their road tax should be increased. By taking a one-time tax,

the transport departments not only cannot check the vehicles every year,

but also cannot keep on increasing the road tax according to age which

will encourage owners to phase out older and polluting vehicles. In Japan,

road taxes rise so rapidly that after 5-6 years everyone buys a new car

leading to a huge market worldwide in second-hand Japanese cars which

is threatening the Indian auto industry with import regulations becoming

weaker and weaker.

Potential for raising

revenue

There are numerous options for raising funds for subsidising the conversion

of the city public transport fleet to CNG to a point that there will be

no need to increase public transport rates.

In 1998-99, the total sale of diesel was 1,451 million litres. An additional

sales tax of Re 1 in 1999 and 2000 would have fetched about Rs 300 crore.

This sum is so large that the government could have even given away more

than 3,000 retrofitted buses free. Such a tax can still be levied to subsidise

the conversion to CNG. Increasing the price of diesel to that of Mumbai

would have netted the government over Rs. 450 crore in one year. With

buses and taxis which run on diesel moving over to CNG, sales of diesel

in Delhi will definitely come down but there will still be a substantial

demand for diesel by goods vehicles and generator sets. Moreover, the

increased price difference between diesel and CNG will make the latter

even more attractive.

Every

year, some 60,000 cars and 115,000 two-wheelers get added to Delhi’s

fleet of vehicles. Even a one-time increase of Rs. 7,500 in the road tax

for cars and Rs. 2,000 for two-wheelers will fetch the Delhi government

Rs. 45 crore and Rs. 23 crore, respectively — a total of Rs. 68 crore

every year. In this way, private vehicle owners can cross-subsidise the

users of public transport who make a much better use of road space. According

to the DTC, buses carry 50 per cent of the passenger load while occupying

only one per cent of the road space.

There is, thus, really no problem in financing the switchover to CNG.

The government can easily provide people with a subsidy of upto Rs. 200-300

crore without losing its existing revenue. For the short-term it can even

take loans to finance the transformation which it can recover from increased

taxes over time. Using the polluter pays principle, taxes could be levied

more on private vehicle owners, users of gensets and those who use polluting

fuels.

The government should provide effective fiscal incentives to the operators

which are anywhere between 20-30 per cent of the total cost of conversion

or of buying a new bus. The government is definitely in a position to

do this.

Price of diesel in Delhi is not only lower than other metros but also lower than neighbouring states where the diesel sold is much poorer in quality