| Ecological

and economic profile of the caustic-chlorine industry There are

broadly two categories of industries. Explained simply, one makes the final product the

way we see them on the shelves and one supplies the raw material or intermediate product

to make the final products. The manufacturing industry depends on the intermediary

industry. The manufacturing industry is at the forefront, normally facing the brunt for

any environmental pollution while the intermediary industry remains obscure from the

public gaze.

That is exactly why the third rating of the Green Rating Project

(GRP) is significant. This time, GRP focuses on the caustic-chlorine industry of India

— a key contributor to the country’s economy as well as pollution. What makes it

worse is the fact that the caustic-chlorine industry has no control over the end use of

the products it manufactures.

Prior to rating the caustic and chlorine sector, GRP had rated the

pulp and paper sector where pollution peaked during production while for the automobile

sector, pollution was maximum during the stage of product usage. The rating of the

caustic-chlorine sector is unique because the issues of concern here relate to:

The output at the end of the production process –

chlorine and caustic soda – that are used extensively by industries to make products

like pesticides and organo-chlorine that are highly detrimental to the environment. The output at the end of the production process –

chlorine and caustic soda – that are used extensively by industries to make products

like pesticides and organo-chlorine that are highly detrimental to the environment.

The utilisation, storage and transportation

of the products. For example, storage of large amount of chlorine is similar to a time

bomb, which if explodes, will kill all living organism within its sphere of influence. The utilisation, storage and transportation

of the products. For example, storage of large amount of chlorine is similar to a time

bomb, which if explodes, will kill all living organism within its sphere of influence.

Deadly mercury pollution and contamination

arising due to emissions of mercury into air, water and land. The fact that an industrial

disaster that occurred 50 years ago continues to haunt the sector and has laid the basis

for a totally new environmental framework indicates the potential environmental danger

associated with the sector. We are referring to the infamous Minamata tragedy where

mercury was dumped into the sea by a Japanese chemical company leading to its toxic

contamination (see box: Liquid death). Deadly mercury pollution and contamination

arising due to emissions of mercury into air, water and land. The fact that an industrial

disaster that occurred 50 years ago continues to haunt the sector and has laid the basis

for a totally new environmental framework indicates the potential environmental danger

associated with the sector. We are referring to the infamous Minamata tragedy where

mercury was dumped into the sea by a Japanese chemical company leading to its toxic

contamination (see box: Liquid death).

Another issue that has considerably impacted the environmental

trends of the Indian caustic-chlorine industry has been the influence of the global market

on the Indian market. A situation has been created for the Indian industry, where on one

hand, it has to deal with chlorine, that is neither storage nor disposal friendly and on

the other hand, it has to face a glut of caustic soda in the market, because of dumping of

caustic soda by China and the countries of the Gulf region.

| Liquid death

Death this time travelled through the waters and found its way into homes

of innocent fishing folk in a seaside town of Japan, killing children in wombs and

affecting a number of people. Statistics cannot put an estimate to the suffering that

spanned three decades.

The Chisso Corporation, one of the main employers of

Minamata, was making petro-chemicals and plastics. From 1932 to 1968, Chisso Corporation

dumped an estimated 27 tonnes of mercury compounds into Minamata Bay. The destruction of

large scale fishing areas following the dumping simply saw the exchange of money to buy

people off. The logic of the company was to pay people in exchange for polluting.

It was not till mid 1950s that people began to notice

a strange phenomenon in animals and humans. People began to experience numbness in their

limbs and lips. Their speech slurred and their vision constricted. Some people had serious

brain damage. Birds started to drop dead from the skies.

The valiant effort of a doctor from Chisso

Corporation itself, Dr Hosokawa, brought the reasons for the disease to light. He faced

resistance to his theory that linked the disease with the dumping of mercury compounds

from the company into the sea. Chisso Corporation initially succeeded in buying the

silence of people but soon the incident came into national and international limelight.

Though the victims testified at the United Nations Environmental Conference in Sweden, the

UN did not intervene. Till a decade ago, the Japanese courts were still resolving suitable

compensation for the victims. It was Minamata which ultimately forced the Japanese

government to ban mercury in all processes and products. It also heralded a new technology

for the caustic-chlorine industry - the membrane cell technology which gave it a new life. |

2.1 Industrial relevance of the

caustic-chlorine industry

The chemical industry in India is possibly the best example to study the process of

industrialisation. The basic inorganic and organic chemicals produced in the chemical

industry provide the building blocks for several downstream industries.

Caustic soda and chlorine - one of the most important inorganic

chemicals - are used by almost all industries for one thing or the other. The importance

of the sector can be gauged by the fact that caustic-chlorine industry is among the twenty

largest chemical industries in the world. Products made from caustic soda and chlorine are

used everyday by people and they have become an integral part of our lifestyle (see table

2.1).

In India, caustic soda is the principal product of the industry

and chlorine is treated as a by product of the industry, though the global

caustic-chlorine industry is driven by chlorine. For an Indian caustic-chlorine industry

to be financially viable, caustic soda has to realise more than 65 per cent of the cost,

as chlorine prices are low. But, in the past few years, chlorine has started getting

importance as a principal intermediate material in the manufacture of PVC.

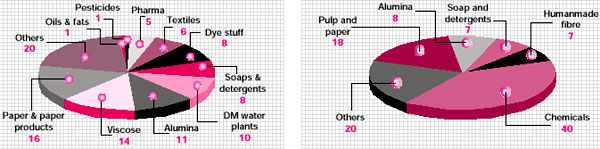

In India, caustic soda is primarily used in the manufacture of

pulp and paper, detergents, viscose, aluminium, petroleum refining, metal cleaning etc.

Paper and pulp sector followed by humanmade viscose fibres and alumina accounts for the

major chunk of caustic consumption (see graph 2.1).

Global consumption pattern of caustic soda differs from

that of India. Globally chemicals account for 40 per cent of the total consumption

followed by paper and pulp with 18

per cent, alumina with 8 per cent, soap and detergents with 7 per

cent and humanmade fibres with 7 per cent. The rest 20 per cent is distributed among other

uses (see graph 2.2).

In the US, the largest user of caustic soda is the organic

chemical industry (30 per cent), and the inorganic chemical industry (20 per cent). The

pulp and paper industry uses about 20 per cent of the US caustic soda production for

pulping wood chips, and other process. In Europe, the chemical industry is the major

consumer of caustic soda followed by the paper industry. Other users are aluminium

industry.

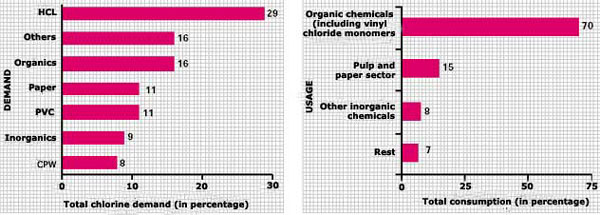

Similar to caustic soda consumption pattern, pulp and paper sector

is one of the major consumer of chlorine in India. However, it is in HCl production that

maximum amount of chlorine is consumed in India (see graph: 2.3). In recent times, the use

of chlorine in PVC manufacturing has also increased and currently about 11 per cent of the

chlorine is consumed by PVC sector. In recent years India has also started to export

substantial quantity of chlorine based products.

Table

2.1 CHLORINE & CAUSTIC SODA — INDISPENSABLE LIFE-LINE OF THE INDUSTRY

|

| SPHERE OF USE/INDUSTRY |

PRODUCTS OR APPLICATIONS OF USE |

| Production of metals and

resource materials |

Alumina, propylene oxide,

polycarbonate resin, epoxies, synthetic fibres, soaps, detergents, rayon and cellophone |

| Pulp and paper industry |

Caustic soda is used for

pulping wood chips. Chlorine and its compounds are used to bleach wood pulp in the paper production process |

| Petroleum and natural gas

extraction industry |

Caustic soda is used as a

drilling fluid |

| Manufacture of organic

chemicals |

Chlorine is used for making

ethylene dichloride, glycerine, glycols, chlorinated solvents and chlorinated

methanes |

| Plastic industry |

Used for making plastics,

most notably polyvinyl chloride (PVC), which is being used extensively in building and

construction, packaging, and many other items |

| Pesticides |

96 per cent of all

pesticides are produced using chlorine |

| Industrial solvents |

A variety of chlorinated

compounds are used as industrial solvents, including the main ingredient used in dry

cleaning. |

| Water treatment |

Chlorine is used in 98 per

cent of the water treatment plants in the world |

| Pharmaceuticals |

85 per cent of all

pharmaceuticals use chlorine at some point in the production process |

| Other relevant applications |

Domestic bleaches,

flame-retardaXts, food additives, refrigerants, insulation, computeX chip manufacturing

and hospital disinfeXtants among others |

Globally, the majority of chlorine production is used in the

manufacturing of organic chemicals including vinyl chloride monomer, ethylene dichloride,

glycerine, glycols, chlorinated solvents, and chlorinated methanes. Vinyl chloride, which

is used in the production of polyvinyl chloride (PVC) and many other organic chemicals,

accounts for one-third of the total chlorine production (see graph 2.4). The other major

consumers are pulp and paper industry, other inorganic chemicals, disinfection treatment

of water and the production of hypochlorites. Globally, more than two-thirds of all

chlorine is consumed in the same manufacturing plant in the production of other chemical

intermediates, though in India two-thirds of all chlorine is sold.

Graph 2.1 INDIAN

DEMAND PATTERN OF CAUSTIC SODA (in percentage) |

Graph 2.2 GLOBAL

CONSUMPTION PATTERN OF CAUSTIC SODA (in percentage) |

|

| Source: CMIE Report,

2000-2001. |

Source: Indianfoline,

reports, Chlor-alkali industry. |

Globally, the caustic-chlorine industry is driven by the

demand-supply of chlorine and not caustic soda. Across the world, demand for chlorine is

higher than that of caustic soda, which is considered a by-product.

The world production of caustic soda is estimated to be around 45

million tonnes per year. The global production of chlorine is in tune of 40 million

tonnes. The global installed capacity of caustic soda in 2001 was about 54.4 million

tonnes while for chlorine, it was about 48 million tonnes.

It is estimated that 65 per cent of the world’s

caustic-chlorine industry is concentrated in three regions; North America, Western Europe

and Japan. Out of this, the share of US is about 30 per cent, the EU accounts for about 25

per cent and Japan’s share is about 10 per cent.

The US is the largest consumer and is also a net importer of

caustic soda, whereas China and Saudi Arabia are the net exporters. The forecast for the

global demand for both chlorine and caustic predicts an increase, although this would

mainly be in Latin America and Asia. Between 1997-2002, the global capacity of the

caustic-chlorine industry is likely to increase by around 6.6 million tonnes per year of

chlorine, largely driven by strong growth projections of PVC in developing countries.

Globally, the economic impact of chlorine is very large. It

affects nearly every industry in one way or the other. For instance, PVC is used in

automobile interiors, construction and nearly every business uses chlorine-bleached paper.

According one estimate, globally the chlorine industry accounts for nearly $71 billion in

sales. The chlorine sector provides a $2.9 billion trade surplus for US and affects an

estimated 40 per cent of the total gross domestic product in US.

| Graph: 2.4 GLOBAL

CONSUMPTION OF CHLORINE (in percentage) |

Graph: 2.3 CHLORINE DEMAND IN INDIA

– VARIOUS SEGMENTS |

|

| Source: Indiainfoline, sector

reports, Chlor-alkali industry. |

Source: CMIE Report, 2000-2001. |

The US is self sufficient in caustic production. Europe is

approximately in balance in chlorine and has traditionally been the world’s second

largest exporter of caustic soda; currently it is a net importer. Australia and South-East

Asia are the main importing areas. New capacity in the Middle East and South-East Asia may

upset these traditional trade patterns. While globally, the chlorine growth may average

2-3 per cent per year over the next 10 years, it is forecast to be less than 1 per cent

per year in Europe and 3-4 per cent per year in India.

2.2 The Indian caustic-chlorine sector - the economic

challenge

In the last few years, the Indian caustic soda companies have not done well financially.

Over capacity and cheaper imports have resulted in a glut of caustic soda in the domestic

market. This can be seen from the fall in capacity utilisation over the years (see table

2.2). Things have improved since 2001 due to the revival of the paper industry. As is the

case with most commodity-based industries, this industry too is cyclical in nature. In

recent times the domestic industry is also facing a over capacity problem. Five

large-scale caustic soda units have come up since 1997 with companies like Reliance

entering this sector. Gujarat Alkalies & Chemicals Ltd (GACL) is the biggest producer

of the sector.

2.2.1 Influence of global politics on Indian industry

The favourable economics of production in the US and Gulf (cheap electricity, salt and

ethylene) make it possible for the US to export ethylene dichloride (EDC), which is the

basic raw material for making PVC, and the Gulf countries to export caustic soda at

attractive prices. The US is the largest exporter of EDC followed by Europe. The main

importing areas are Australia (alkali for the alumina industry) and South-East Asia (EDC

and caustic).

Table 2.2 CAUSTIC

SODA PRODUCTION TRENDS IN INDIA |

YEAR |

INSTALLED CAPACITY

(000’MT) |

PRODUCTION

(000’MT) |

DEMAND

(000’MT) |

SUPPLY (000’MT) |

CAPACITY UTILISATION

(in percentage) |

1995-1996 |

1,673.0 |

1,308.7 |

1,346.0 |

1,448.6 |

78 |

1996-1997 |

1,914.0 |

1,320.0 |

1,331.5 |

1,460.1 |

69 |

1997-1998 |

2,028.5 |

1,416.8 |

1,506.5 |

1,561.9 |

70 |

1998-1999 |

2,272.1 |

1,492.2 |

1,558.2 |

1,640.5 |

66 |

1999-2000 |

2,251.4 |

1,514.0 |

1,548.2 |

1,576.8 |

67 |

Source: Alkali

Manufacturers Association of India. |

The market conditions are such that caustic soda is in demand in

India while chlorine is not; while globally the industry requires more chlorine than

caustic soda. Though Indian companies have excess chlorine, they cannot export it simply

because of the major hazards associated with transportation of chlorine. Chlorine also

finds a place in the list of toxic and hazardous substances banned for transnational

transportation under the Basel Convention on hazardous wastes. As a result, India is faced

with a double edged sword – on one hand, it has a growing chlorine stock that it

cannot dispose off and on the other hand, the dumping of caustic soda is forcing the

sector to compete with low international prices. This is unviable for the sector as its

production costs are high.

As mentioned earlier, the Indian caustic-chlorine industry is

highly influenced by the global manufacturing and market conditions. The reasons that make

it difficult for the industry to break the existing shackles and face the onslaught of

foreign dumping are the following:

Sector still dependent on imported technology

Sector still dependent on imported technology

Though the sector is moving towards a cleaner technology (i.e. membrane cell technology),

the country is not equipped to provide this technology indigenously. The sector is

dependent on imports for even replacement of cell consumables, which is very expensive.

In addition, there is a high import duty on getting membranes.

Though the import duty for new membrane cell plants was as high as 25 per cent in

1997-1998, it has been brought down to 15 per cent in 1999-2000. However, spares for

repair including replacement of worn out membranes still attracts 30 per cent import duty.

These factors have made the conversion to membrane technology an

unviable option and hence most of the companies who have converted to membrane are not

doing well financially.

Differential

power tariffs Differential

power tariffs

The sector is affected by the difference in energy costs in India and abroad. Energy

consumption is about 70 per cent of the cost of making chlorine and caustic soda in India.

Compared to international power tariff levels of US 2 cents per kilowatt, current tariffs

in India are close to 8-9 cents per kilowatt1. In addition, the power supply is highly

unreliable with frequent fluctuation resulting in lower operational efficiencies and

higher input costs.

Lowering

of custom duty on imports of caustic soda led to glut in Indian market Lowering

of custom duty on imports of caustic soda led to glut in Indian market

The industry is against the reduction in customs duty on imports of caustic soda. As of

1996-1997, the lower customs duty opened the floodgates for foreign imports as a result of

which the expanding PVC sector started shipping in chlorine derived EDC from the Arabian

Gulf and Gulf of Mexico, where energy prices were lower. Other countries like France and

Japan were also found dumping caustic soda at a very low price in Indian market resulting

in a glut. This resulted in considerable increase in imports in 1997-1998 and 1998-1999

(see table 2.3).

The sector had made several representations to the government for

levying anti dumping taxes on these countries. As a result, government introduced an

anti-dumping duty on imports for caustic soda. The anti-dumping duty levied on

manufacturers from Japan is US$ 319.4 per tonne of caustic soda while it is US$ 309.4 for

French exporters and US$ 266.9 per tonne of caustic soda for Saudi Arabia.

Table 2.3 CAUSTIC SODA

– SUPPLY & DEMAND IN INDIA (in ’000 MT) |

YEAR |

PRODUCTION |

IMPORTS |

TOTAL DOMESTIC

AVAILABILITY

(Including opening stock) |

EXPORTS |

DOMESTIC CONSUMPTION |

1996-1997 |

1,320.0 |

64.0 |

1,403.2 |

56.9 |

1,331.5 |

1997-1998 |

1,416.8 |

116.0 |

1,547.6 |

17.3 |

1,506.5 |

1998-1999 |

1,492.2 |

94.5 |

1,610.5 |

30.0 |

1,156.0 |

1999-2000 |

1,514.0 |

60.0 |

1,598.5 |

28.3 |

1,548.2 |

Source:

23rd Annual Report of Alkali Manufacturers Association of India, 1999-2000 |

The sector is now pushing for stopping all imports by making it

mandatory for Indian companies like NALCO to use domestic products.

2.2.2 The future of the Indian caustic-chlorine industry

The co-production of chlorine and sodium hydroxide in fixed proportions, 1.128 tonnes of

caustic (as 100 per cent NaOH) per tonne of chlorine produced, has always been a problem

for the caustic-chlorine industry. Both products are used for very different end uses with

differing market dynamics and it is only by rare chance that demand for the two coincides.

Depending on demand for which product is dominant, either can be regarded as a

by-product.The price then varies accordingly. Price fluctuations can be extreme: in the

spot market in cases of oversupply, caustic prices variation can be as low as US$ 20-30

per tonne of caustic soda whereas, in short supply, prices can be US$ 300 and higher per

tonne of caustic soda2.

Overall, with caustic soda being excess in the major producing

countries, the Indian market is likely to be flooded with cheap caustic soda imports

making it difficult for the Indian companies to compete with global players on price. In

addition, the existing excess capacity in the Indian industry further floods the market

with caustic soda. This, coupled with increased cost of production due to increase in

power cost, will affect the performance of existing players adversely in coming future.

Paper and pulp, man-made fibres, soaps and alumina are the major

user sectors of caustic soda. Together they account for more than 80 per cent of the

domestic demand. The paper and pulp sector has been growing at the rate of around 6 per

cent per annum in volume terms. The soap industry is expected to grow at the rate of

around 9-10 per cent per annum. The demand for caustic soda will grow from this industry.

Caustic soda is used in the conversion of bauxite into alumina, though the demand from

this sector is sluggish. The demand from humanmade fibre industry has slowed down as the

sector itself is growing at a pace of 6 per cent per annum. Therefore, the overall demand

of caustic soda is expected to grow at a rate of 6-7 per cent per annum in the future. The

domestic industry can also grow at this rate only if it is able to compete with the cheap

imports. Survival is going to be hard even for the most efficient companies.

According to financial accounting definition, the responsibility

of a company ends at the physical boundary of the company. If one uses this definition,

then the environmental challenges facing the caustic-chlorine industry is rather

manageable. It just has to get rid of the mercury cell technology.

However, if one considers the definition of boundary as per

environmental accounting, wherein the boundary is defined as the environmental impact of

the company’s processes and products right from sourcing of raw material to the final

disposal of the product, the environmental challenges that caustic-chlorine industry

faces, is as big as it can ever get for a industrial sector (see table 2.4). In this case,

the caustic-chlorine industry will have to take responsibility for the environmental

impact of not only the production plant, but also the final products made from the

products it produces (mainly caustic soda and chlorine).

2.3.1 Range of issues involved in the caustic-chlorine

industry

The sheer range of issues related to the caustic-chlorine industry demand that the

environmental impact study of the sector be done in two separate segments. Accordingly,

the division has been done as follows:

Environmental impact

from the production plant of caustic-chlorine industry; and, Environmental impact

from the production plant of caustic-chlorine industry; and,

Environmental impact of

the products of caustic-chlorine sector once it leaves the plant premises. Environmental impact of

the products of caustic-chlorine sector once it leaves the plant premises.

Environmental performance of production plant

Environmental performance of production plant

The vulnerability and dangers of mercury losses during the

production process and leakage of chlorine during process and from storage is a constant

nightmare to both the industry and environmentalists.

Forewarned but not forearmed

If the Minamata disaster is an example of a deliberate and slow

murder, then the oleum gas leak at Shriram is about the callousness of the management

despite being forewarned.

It was a disaster in the waiting at the Shriram Foods &

Fertiliser Industry, situated bang in the middle of populated middle class colonies of

Delhi.

Preliminary reports had expressed concern about the safety

arrangements at the plant. A parliament question had been raised about the possibility of

major leakage of liquid chlorine from the caustic-chlorine unit of Shriram Fertilisers.

In reply, the Minister of Chemical and Fertilisers stated that the

government was fully conscious of the problem of hazards from dangerous and toxic

processes and assured the House that the necessary steps for securing observance of safety

standards would be taken in the interest of the workers and the general public. Pursuant

to this assurance, an expert committee examined the safety and pollution control measures

covering all aspects such as storage, manufacture and handling of chlorine. Headed by

Manmohan Singh, the committee made various recommendations in this report and went to the

extent of saying that the caustic-chlorine plant cannot be allowed to be restarted unless

these recommendations are strictly compiled with by the management.

On December 4, 1985, a major leakage of oleum gas took place as a

result of a tank that burst after the collapse of the structure it was mounted on. This

was followed by another leak after a couple of days from the joints of a pipe. It resulted

in the death of an advocate and affected the health of a large number of people. The issue

here is not the extent of damage but the fact that the company had simply looked the other

way after being warned of potential disaster. This is one instance where we hope that

history will not repeat itself. |

However, two environmental disasters, Minamata in Japan and the

oleum gas leak in Delhi alone (see box: Forewarned but not forearmed) have pushed industry

to clean up its act at the production plant.

Moving towards cleaner technology

With increasing awareness on environmental issues especially with

respect to mercury pollution an era of change is sweeping the caustic-chlorine industry.

The mandatory rule by the Indian Government in 1986 that new

caustic-chlorine plant should only be installed with membrane cell technology has

expedited the eventual shift from mercury cell technology to membrane technology. While in

1960s and 1970s, most of the companies were using mercury or diaphragm cell technology,

today in India, 69 per cent of companies use membrane cell while 31 per cent still use

mercury cells.

Capacity of caustic-chlorine sector increased substantially in

1990s when some big companies were set up using membrane cell technology like Indian

Petrochemicals Corporation Ltd, Reliance Industries, Shriram Alkalis & Chemicals Ltd,

etc. In addition, number of companies earlier using mercury cells changed to membrane

during 1990s such as NRC Ltd – Chemical Division, Punjab Alkalies & Chemicals

Ltd, Grasim Industries Ltd, etc. The membrane technology has advantage over mercury cells

in terms of absence of mercury pollution and energy efficiency. |

Today, the level of environment management that one sees in

the Indian caustic-chlorine industry is nothing less than the global best. The sector has

slowly moved away from the toxic mercury cell process and more than 70 per cent of the

sector uses the best available membrane cell technology at their production plant. (see

box: Moving towards cleaner technology) Compared to Europe and the US, where more

companies are using the polluting mercury cell and diaphragm cell technology respectively,

the effort of the Indian caustic-chlorine sector in moving towards membrane cell

technology is truly commendable. Even at the production plant, the performance of Indian

caustic-chlorine sector is more or less comparable to the global best performance (except

in mercury emission). The energy consumed by Indian caustic-chlorine industry is probably

the least in the world and their consumption efficiency too rivals the global best

performance. In addition, to make sure that their eco-friendliness is recognised, they

have obtained internationally acknowledged certifications for their environment, health

and safety performance. Out of all industrial sectors of India, the percentage of total

companies having ISO 14001 for environment and ISO 18001 for health and safety is probably

the maximum in the Indian caustic-chlorine industry. However, the biggest challenge that

the sector faces is the reduction in mercury pollution. Currently, Indian companies

consume as much as 50 times more mercury than a European mill and this is the difference

that Indian companies have to eliminate.

Environmental

performance of the products Environmental

performance of the products

The ultimate use of chlorine is not under the control of the caustic-chlorine industry.

The downstream industry makes environmentally damaging products like plastics, pesticides

and organo-chlorine from chlorine. Serious questions of adverse health and environmental

effects of chlorine and chlorinated compounds have been raised.

Central to the case against chlorine is the contention that

chlorinated substances are, as a group, health and environmental hazards. Many chlorinated

compounds do show up on lists of toxic substances developed by various government

agencies. Chlorinated organic compounds, or ‘organochlorines,’ are toxic,

bioaccumulative and the cause of problems such as cancer, immune suppression, birth

defects, fertility problems and endocrine disruption. Dioxin - a chlorinated substance -

is currently being studied by the United States Environmental Protection Agency as being

the culprit in a variety of health and environmental problems. Other chlorinated

compounds, such as CFCs are ozone depleters and are already being phased out. The good

technical properties of chlorine have actually given it a bad reputation: chlorine has

strong binding properties and is a building block in several chemicals that do not break

down easily, like PCB and CFC.

In the past few years, numerous groups from industry, government

and NGOs have formed to explore the health and environmental issues associated with

chlorine use. Some have issued calls to phase out chlorinated compounds, while others have

called for further study.

The chlorine controversy is only likely to snowball with increase

in scientific research on the issues. Hopefully, the decisions affecting chlorine will be

based on rational science and risk assessment, resulting in a better quality of life. |

![]()